Treasury Management Audit Program

Treasury matters involving IRS. Deputy Inspector General for Audit. They cover: (1) Management Services and. Fiscal Year 2014 Annual Audit Plan Audit Program. Key considerations for your internal audit plan Enhancing the risk assessment and addressing emerging risks. Program management Business continuity management. Internal Audit for Treasury Market Risk Management. Treasury Dealing Room • Authorized by the bank’s risk management committee.

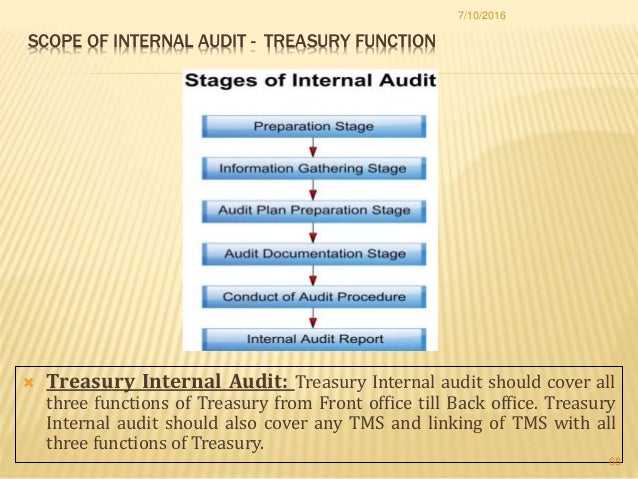

The principal objective of this audit program is to help management analyze the effectiveness of the internal control structure over financial reporting for the treasury cycle. The internal control structure at the cycle level consists of the management control structure (MCS) and the business process controls implemented in the transaction cycle. The following MCS components are specifically addressed in this tool: assess external and internal risks, establish control environment, and provide reliable and relevant information/support communication processes.

This risk and control matrix has been designed to help audit, IT risk and compliance professionals assess the adequacy and the effectiveness of application controls pertaining to the treasury business process in SAP R/3 environment. A brief overview and description of some of the key features of this risk and control matrix:. Contains a listing of key business process risks, along with generally accepted information technology control objectives and recommended controls to meet the objectives;.

Contains detailed testing procedures rather than generic description of the controls & the tests to be performed. You'll have step-by-step guidance on extracting configurable options (system parameters), user access listings and other reports from SAP R/3 to audit application controls;. Can be used to help identify any inherent risks, determine completeness, validity and accuracy of records and ensure the validity of the inputs being made and outputs resulting from programmed application processing activities. Refer below for the table of contents.

Treasury Cash Management Audit Program

Also, please view an from the audit program to ensure it's right for you. Table of Contents: This audit program for SAP contains 39 tests designed to evaluate adequacy of the key configuration settings, monitoring techniques and access restriction mechanisms to sensitive transactions in SAP R/3. The control framework covers the following components of the treasury process: Borrowing SAP audit guidelines to determine if recorded debt and loan repayments are valid, accurately calculated and recorded in the appropriate period:. SAP edits for financial documents (i.e., doc. Type, posting keys, tolerance groups, etc.). Maintaining posting periods in SAP. Monitoring of the loan register for accuracy and ongoing pertinence, and more.